In the case you do, can I also try it for few days (a week or so) before becoming a member. I therefore would like to ask you if you can provide me with a scanner that, once my strategy (parameters of the moving averages and stochastic) is defined, I simply have to run it at any time of the day to fined if any stock has met the defined preliminary trading conditions. I however have no way to keep an eye on them to see which one has presented the opportunity to buy or short it, and I am often jumping from one stock to another, only to see the opportunities I have missed. I also have a pool of about a dozen stocks.

BEST MOVING AVERAGE FOR DAY TRADING FULL

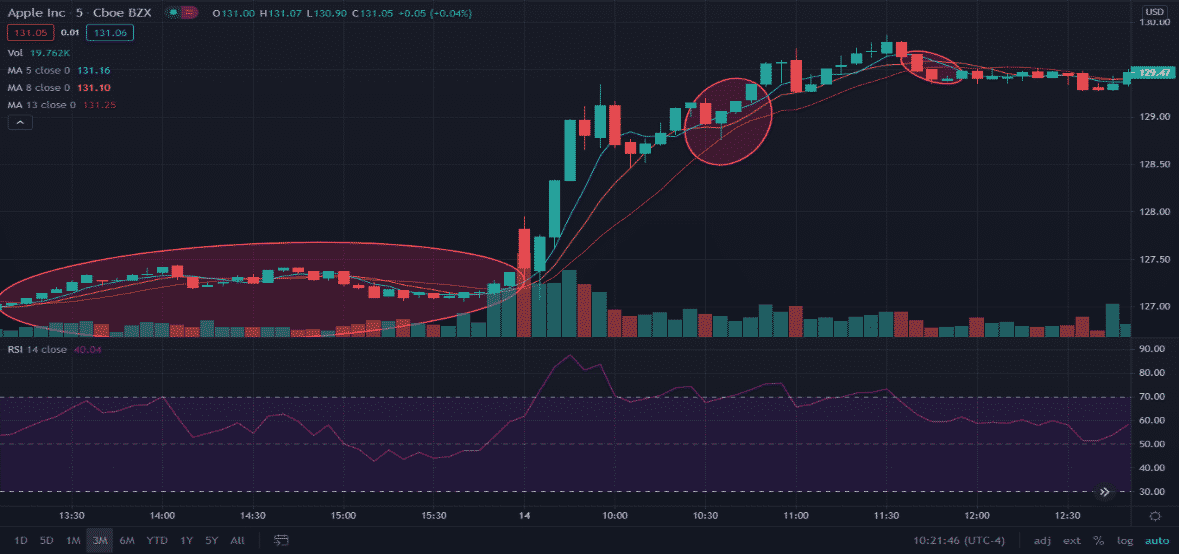

It uses the full stochastic and and three moving averages (2 WMA and 1 SMA). I developed my own trading strategy, which is rather simple. This makes my situation very comparable to that of a soldier in the battle-field, well armed nut with no communications.

I have an online broker who provides quite an arsenal of indicators but no alert system. I am trader, mainly day trading those days, because of the market instability. To learn our complete and winning stock trading system, check out our top-ranked Swing Trading Success Video Course. More importantly, using the 10-day moving average as a short-term indicator of support enables us to TRADE WHAT WE SEE, NOT WHAT WE THINK! While the 5 and 10-day moving averages are by no means a complete and perfect system for exiting a position, they allow us to stay with the trend in a winning trade (which helps us to maximize our trading profits). However, since that did not occur, we canceled our buy stop and continue to hold $USO with reduced share size and a small unrealized gain since the breakout entry. Immediately after selling partial share size on the break of the 10-day MA, we were prepared to buy back those shares if the price action immediately snapped back higher within one to two days (as $FDN did). It never hurts to lock in profits on partial share size when a breakout stock or ETF has broken below its 10-day moving average because such price action frequently leads to a deeper correction. As such, we sold 25% of our existing position on July 25. On the other hand, notice the difference on the daily chart of $USO:Īs you can see, $USO has failed to hold above its 10-day MA over the past week, which is a sign that bullish momentum from the recent breakout is fading. This is a clear sign that the momentum from the breakout is still strong. With the exception of a brief “shakeout” of just two days (a common and acceptable occurrence), notice that $FDN has been holding above its rising 10-day MA ever since breaking out in early July. Oil Fund ($USO) and First Trust DJ Internet Index Fund ($FDN). To understand why, compare the following daily charts of U.S.

The 10-day MA is a great moving average for helping us ride the trend with a bit more “wiggle room” than provided by the ultra short-term 5-day MA.įor trend traders, no stocks or ETFs should be sold while they are still trading above their 10-day moving averages following a strong breakout.

One possible exception is if the stock or ETF has made a 25-30% price advance within just a few days. If, for example, a stock or ETF is trading above its 5-day MA, there is usually no good reason to sell. One of the easiest and most effective ways to find support and resistance levels is through the use of moving averages. Moving averages play a very big role in our daily stock analysis, and we rely heavily on certain moving averages to locate low-risk entry and exit points for the stocks and ETFs we swing trade.įor gauging price momentum in the very short-term (a period of several days), we have found the 5 and 10-day moving averages work very well. As such, we now avoid this problem by simply focusing on the tried and true basics of technical trading: price, volume, and support/resistance levels. However, we quickly discovered that using too many indicators only led to analysis paralysis. While learning to master our winning system for swing trading stocks and ETFs in the early years, we tested a plethora of technical indicators. Our conclusion was that most of the technical indicators served their intended purpose of increasing the odds of a profitable stock trade. But how is a new trader supposed to know which indicators are most reliable? Deciding which technical indicators to use can frankly be a bit overwhelming, but it doesn’t have to be (nor should it be). Swing traders rely on a diverse arsenal of technical indicators when analyzing stocks, and there are literally hundreds of indicators to choose from.

0 kommentar(er)

0 kommentar(er)